Your Education, Your Way

Undergraduate

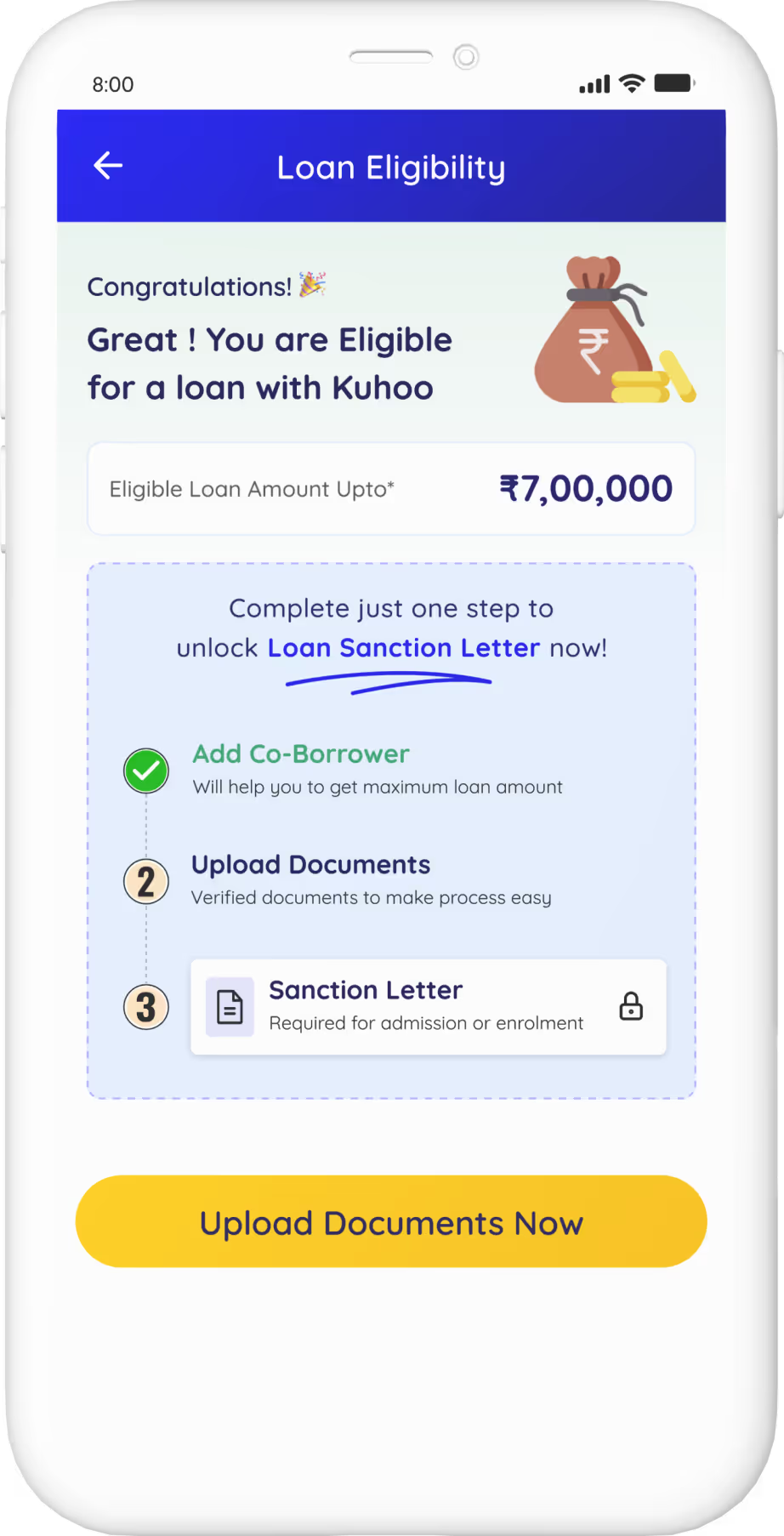

Loans

Easy funding to kickstart your dreams.

Postgraduate

Loans

Cover Tuition, Travel, & Living Expenses for your global adventure.

Professional Courses

Loans

Covering all streams in Medical, Pilot, and Law

courses

courses